2025 HSA Limits: Maximize Tax-Advantaged Healthcare Savings

The latest on The 2025 Health Savings Account (HSA) Contribution Limits: Maximizing Tax-Advantaged Healthcare Savings (RECENT UPDATES, FINANCIAL IMPACT) details crucial adjustments impacting financial planning for individuals and families in the United States, providing a clear roadmap for optimizing healthcare expenditures.

The 2025 Health Savings Account (HSA) Contribution Limits: Maximizing Tax-Advantaged Healthcare Savings (RECENT UPDATES, FINANCIAL IMPACT) is a critical topic for millions of American families navigating rising healthcare costs. As the Internal Revenue Service (IRS) announces these updated figures, understanding their implications becomes paramount for effective financial and health planning. This article provides a timely, factual overview of the new limits, their financial impact, and strategies to leverage these tax-advantaged accounts effectively.

Understanding the 2025 HSA Contribution Limits

The IRS annually adjusts various tax provisions, including the 2025 HSA Contribution Limits, to account for inflation and other economic factors. These adjustments directly influence how much individuals and families can contribute to their Health Savings Accounts, affecting their tax benefits and long-term healthcare savings potential. Staying informed about these changes is essential for maximizing the unique advantages HSAs offer.

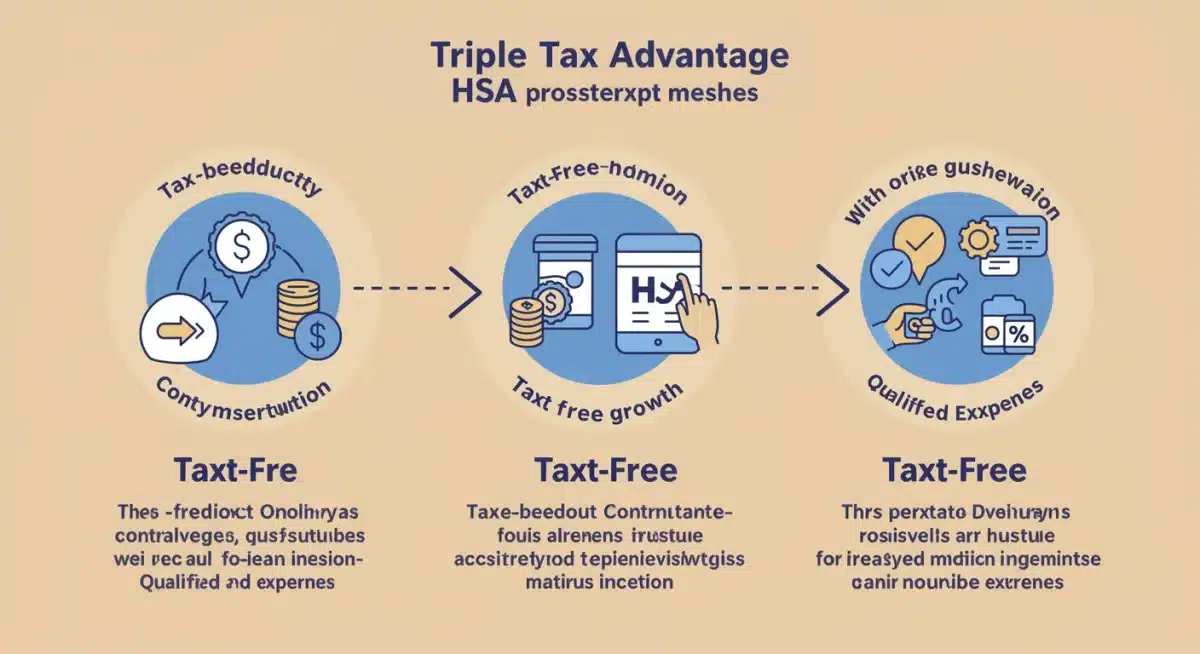

Health Savings Accounts are powerful financial tools designed to help individuals with high-deductible health plans (HDHPs) save for medical expenses on a tax-advantaged basis. The triple tax advantage – tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses – makes HSAs a cornerstone of smart financial planning for healthcare. The updated limits for 2025 reflect ongoing efforts to ensure these accounts remain relevant and beneficial in a dynamic economic landscape.

Key Changes for Individuals and Families

- Individual Coverage: For 2025, individuals enrolled in an HDHP can contribute up to a specific amount. This figure represents an increase from the previous year, allowing for greater tax-advantaged savings.

- Family Coverage: Families with HDHPs will also see an adjusted, higher contribution limit for 2025, providing more capacity to save collectively for their healthcare needs.

- Catch-Up Contributions: Individuals aged 55 and over can continue to make additional catch-up contributions, further enhancing their ability to save for future medical costs as they approach retirement.

These new limits, officially announced by the IRS, are not merely statistical adjustments; they represent tangible opportunities for families to bolster their financial security against unexpected health events and plan for long-term medical care. It is crucial for eligible individuals to review their current contribution strategies and adapt them to the 2025 guidelines to fully capitalize on these benefits.

Eligibility Requirements and HDHP Criteria for 2025

To contribute to an HSA, individuals must be covered by a High-Deductible Health Plan (HDHP) and meet specific criteria outlined by the IRS. These requirements ensure that HSAs are utilized as intended – to complement health plans that encourage consumer-driven healthcare choices. Understanding the precise definitions for 2025 is vital for determining eligibility and avoiding potential penalties.

An HDHP is characterized by a minimum deductible and a maximum out-of-pocket expense limit. These thresholds are also subject to annual adjustments by the IRS, aligning with the 2025 HSA Contribution Limits. For the upcoming year, both the minimum deductible and the maximum out-of-pocket amounts have been updated, directly impacting which health plans qualify as HDHPs.

Defining a High-Deductible Health Plan

- Minimum Deductible: For 2025, an HDHP must have a deductible of at least a specified dollar amount for individual coverage and a higher amount for family coverage. This minimum must be met before the plan begins to pay for most medical services.

- Maximum Out-of-Pocket: The annual out-of-pocket expenses, including deductibles, co-payments, and co-insurance, cannot exceed a certain limit for individual coverage and a higher limit for family coverage. This maximum excludes premiums.

- Other Health Coverage: Generally, you cannot be covered by any other health plan that is not an HDHP, with some exceptions for specific types of coverage like dental, vision, or accident insurance.

It is imperative for individuals and families to verify that their health insurance plan for 2025 meets these updated HDHP criteria. If a plan no longer qualifies, or if an individual gains other disqualifying coverage, contributions to an HSA may need to cease to remain compliant with IRS regulations. Consulting with a benefits administrator or financial advisor can provide clarity on specific situations.

Maximizing Tax Advantages with Your HSA in 2025

The primary appeal of Health Savings Accounts lies in their robust tax advantages, often referred to as the "triple tax advantage." For families and individuals, particularly those focused on home economics and long-term financial stability, leveraging these benefits with the 2025 HSA Contribution Limits can significantly enhance overall savings and reduce tax burdens. Understanding how to maximize these advantages is key to effective financial planning.

Contributions to an HSA are tax-deductible, reducing your taxable income in the year they are made. The funds in an HSA grow tax-free through investments, similar to a 401(k) or IRA. Furthermore, withdrawals for qualified medical expenses – which can include a wide range of services from doctor visits to prescription medications – are completely tax-free. This combination makes HSAs an incredibly efficient vehicle for healthcare savings.

Strategies for Optimal HSA Utilization

- Contribute the Maximum: Aim to contribute the full individual or family limit for 2025, plus any eligible catch-up contributions. This ensures you capture the maximum tax deduction and allow more funds to grow tax-free.

- Invest Your Funds: Once a comfortable cash reserve is established for immediate medical needs, consider investing the remaining HSA balance. Many HSA providers offer investment options, allowing your funds to potentially grow significantly over time.

- Pay for Medical Expenses Out-of-Pocket (If Possible): If your current budget allows, paying for smaller medical expenses out-of-pocket and letting your HSA funds grow untouched can be a powerful long-term strategy. You can reimburse yourself tax-free later for these past expenses, even years down the line, as long as you keep meticulous records.

For single parents and families managing tight budgets, the tax deductions from HSA contributions can provide immediate relief on their annual tax bill. Over time, the tax-free growth and withdrawals can create a substantial fund for future medical needs, offering peace of mind and financial flexibility. Strategic use of an HSA is not just about saving for today’s health costs, but also about building a robust financial safety net for tomorrow.

Financial Impact on Families and Single Parents

The updated 2025 HSA Contribution Limits hold significant financial implications for families and single parents, directly affecting their ability to manage healthcare costs, save for the future, and improve their overall financial well-being. With healthcare expenses being a major concern for many households, understanding and utilizing HSAs effectively can provide much-needed relief and strategic advantage.

For families, the increased contribution limits mean more money can be set aside on a tax-advantaged basis, buffering against the high deductibles associated with HDHPs. This is particularly beneficial for those with children, as pediatric care, unexpected illnesses, and regular check-ups can quickly accumulate costs. The ability to save more tax-free means more of their hard-earned money stays in their pockets.

Benefits for Single-Parent Households

- Tax Relief: The tax-deductible nature of HSA contributions can lower a single parent’s taxable income, potentially leading to a larger tax refund or a reduced tax liability. This can be crucial for managing household budgets.

- Emergency Fund for Health: HSAs act as a dedicated emergency fund for medical expenses. For single parents, who often bear the sole financial responsibility for their children, having these funds readily available for unforeseen health issues provides immense security.

- Long-Term Savings: Despite immediate needs, HSAs can also serve as a long-term investment vehicle. Funds not used for current medical expenses can grow and be used in retirement, offering a tax-free source of income for medical costs later in life.

Recent updates to HSA limits provide an opportunity for families and single parents to re-evaluate their financial strategies. By maximizing contributions to their HSAs, they can not only mitigate the immediate financial impact of healthcare but also build a substantial nest egg for future medical needs, contributing to greater financial stability and peace of mind. This aligns perfectly with the focus on home economics and care and well-being for families.

Comparing HSA with Other Retirement and Savings Accounts

While HSAs are primarily known for healthcare savings, their unique tax advantages often lead financial experts to dub them the "most powerful retirement account" available, especially when compared to 401(k)s and IRAs. Understanding these distinctions and how the 2025 HSA Contribution Limits position HSAs in the broader financial planning landscape is essential for optimizing long-term wealth accumulation.

Unlike 401(k)s and traditional IRAs, which offer tax deductions for contributions and tax-deferred growth but tax-taxable withdrawals in retirement, HSAs provide a triple tax advantage. This means contributions are tax-deductible, earnings grow tax-free, and qualified withdrawals are also tax-free. No other account offers this level of tax efficiency for both contributions and withdrawals.

HSA vs. 401(k) and IRA: Key Differences

- Tax Treatment: HSAs offer tax deductions on contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. 401(k)s and IRAs offer tax deductions (Traditional) or tax-free withdrawals (Roth) but not both in the same way an HSA does.

- Withdrawal Flexibility: After age 65, HSA funds can be withdrawn for any purpose without penalty, though non-medical withdrawals will be taxed as ordinary income. This makes them highly flexible in retirement, acting as a supplementary retirement fund if healthcare costs are lower than anticipated.

- Portability: HSAs are owned by the individual, not the employer, meaning they are fully portable if you change jobs, unlike some 401(k) plans that may have restrictions or require rollovers.

For those prioritizing retirement savings, fully funding an HSA up to the 2025 limits can be a more advantageous first step than maximizing other retirement accounts, especially if you anticipate significant healthcare costs in retirement. The ability to pay for medical expenses tax-free, even decades later, adds a layer of financial security that traditional retirement accounts cannot match.

Planning Your Healthcare Budget for 2025 and Beyond

Effective healthcare budgeting is a cornerstone of family financial stability, and the new 2025 HSA Contribution Limits provide an opportune moment to reassess and refine your strategy. Proactive planning ensures that you are not only meeting immediate medical needs but also building a robust financial defense against future healthcare expenses, which continue to be a significant concern for many households.

When planning your healthcare budget, consider not just your monthly premiums and deductibles, but also potential out-of-pocket costs for doctor visits, prescriptions, and unforeseen medical events. The HSA serves as an excellent vehicle to save for these expenses, offering a buffer that protects your regular savings and investment accounts from being depleted by healthcare shocks.

Steps for Robust Healthcare Financial Planning

Start by reviewing your family’s projected healthcare needs for 2025. This includes routine check-ups, any known medical conditions, and potential prescription costs. Factor in the deductible and out-of-pocket maximums of your HDHP to understand your worst-case scenario for the year. This clarity allows you to set realistic contribution goals for your HSA, aiming to cover at least your deductible, if not the full out-of-pocket maximum.

Once you have a clear picture of potential expenses, establish a consistent contribution schedule to your HSA, ideally through payroll deductions if offered by your employer. This "set it and forget it" approach helps ensure you meet the 2025 limits without feeling the pinch of large lump-sum contributions. Remember to take advantage of any employer contributions, which are essentially free money for your healthcare savings.

Beyond immediate needs, consider the long-term. Healthcare costs in retirement are a significant financial burden for many. By consistently maxing out your HSA and investing the funds, you can build a substantial tax-free reservoir for medical expenses in your golden years. This forward-thinking approach transforms your HSA from a mere spending account into a powerful long-term investment and retirement planning tool, significantly enhancing your financial resilience.

Key Aspect > | Brief Description > |

|---|---|

2025 Contribution Limits > |

IRS-adjusted maximums for individuals and families to contribute to HSAs, enabling greater tax-advantaged savings. > |

Eligibility Criteria > |

Requires enrollment in a High-Deductible Health Plan (HDHP) meeting specific deductible and out-of-pocket thresholds for 2025. > |

Triple Tax Advantage > |

Contributions are tax-deductible, funds grow tax-free, and qualified withdrawals are tax-free, maximizing savings. > |

Financial Impact > |

Provides significant tax relief and a dedicated savings vehicle, vital for families and single parents managing healthcare costs. > |

Frequently Asked Questions About 2025 HSA Limits

For 2025, individuals with self-only HDHP coverage can contribute up to $4,150, and those with family HDHP coverage can contribute up to $8,300. These figures represent increases from the previous year, offering more capacity for tax-advantaged healthcare savings.

Yes, individuals aged 55 and over can make an additional catch-up contribution of $1,000 in 2025. This amount remains unchanged from previous years, providing an important avenue for older individuals to boost their healthcare savings.

For 2025, an HDHP must have a minimum deductible of $1,700 for self-only coverage and $3,400 for family coverage. The maximum out-of-pocket expenses are $8,550 for self-only coverage and $17,100 for family coverage.

The triple tax advantage (deductible contributions, tax-free growth, tax-free withdrawals for medical expenses) provides significant relief. It lowers taxable income, allows funds to grow untouched, and ensures that money spent on healthcare isn’t taxed, crucial for managing family budgets.

Aim to contribute the maximum allowable amount, including catch-up contributions if eligible. Consider investing a portion of your HSA funds for long-term growth and, if financially feasible, pay for smaller medical expenses out-of-pocket to allow your HSA balance to compound.

Looking Ahead: Navigating Healthcare Savings

The 2025 HSA Contribution Limits underscore the ongoing importance of proactive financial planning for healthcare. These updated figures provide a clear framework for individuals and families to leverage tax-advantaged savings, mitigating the impact of rising medical costs. As we move forward, monitoring future IRS adjustments and continuously assessing personal healthcare needs against available financial tools will be paramount. For families, especially single parents, maximizing HSA contributions remains a critical strategy for both immediate financial relief and long-term security in an evolving healthcare landscape.