Childcare Grants 2025: Federal & State Assistance Guide

Latest developments on Unlocking Government Grants for Childcare in 2025: A Guide to Federal and State Assistance Programs (INSIDER KNOWLEDGE, FINANCIAL IMPACT) with key facts, verified sources, and what readers need to monitor next in Estados Unidos, presented clearly in Inglês (Estados Unidos) (en-US).

Unlocking Government Grants for Childcare in 2025: A Guide to Federal and State Assistance Programs (INSIDER KNOWLEDGE, FINANCIAL IMPACT) is shaping today’s agenda for countless families across the United States. As 2025 approaches, understanding the nuances of available financial aid, from federal initiatives to state-specific programs, becomes crucial for managing household budgets and ensuring quality care for children. This guide prioritizes what’s new, why it matters, and what to watch next.

Understanding the Federal Child Care and Development Fund (CCDF) in 2025

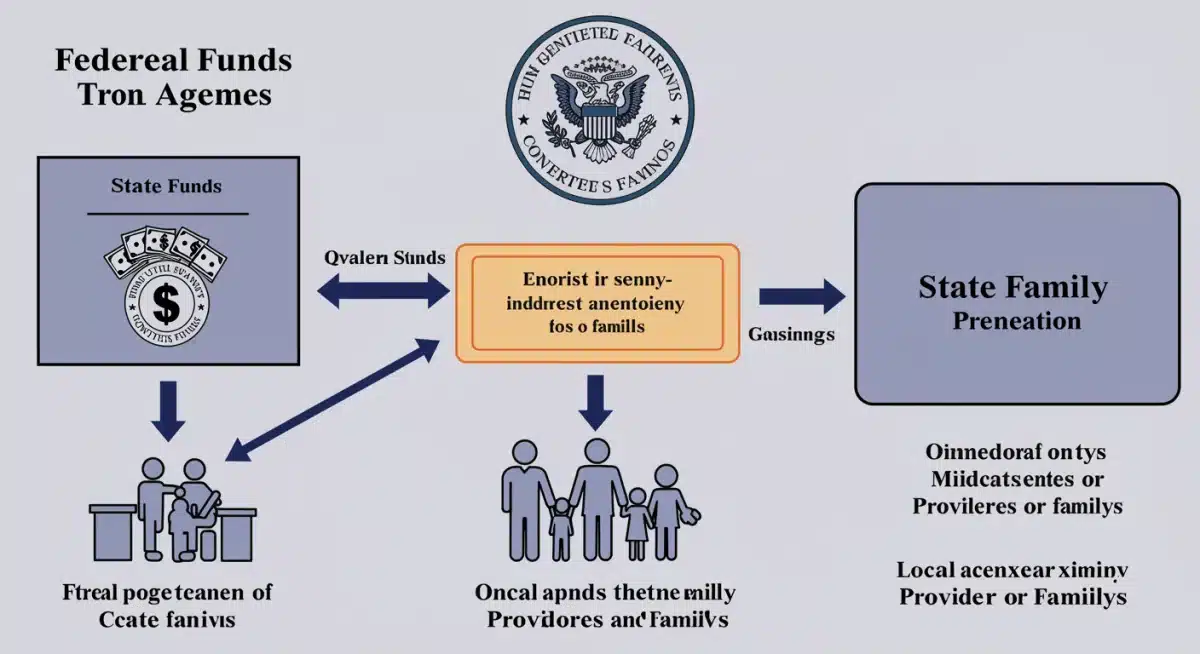

The Child Care and Development Fund (CCDF) remains the primary federal funding source for childcare assistance, providing block grants to states, territories, and tribal communities. For 2025, officials indicate a continued focus on increasing access to affordable, high-quality childcare for low-income families and those working towards self-sufficiency. Understanding how these funds trickle down and impact local availability is paramount for families seeking support.

Recent reports from the Department of Health and Human Services (HHS) highlight efforts to streamline application processes and enhance transparency regarding fund allocation. The objective is to ensure that more eligible families can readily access the assistance they need without undue bureaucratic hurdles. State agencies are currently updating their implementation plans to align with federal guidelines for the upcoming fiscal year.

Key Changes and Priorities for CCDF in 2025

- Increased Funding Allocations: While final figures are pending congressional approval, projections suggest a potential increase in CCDF appropriations to meet growing demand and combat rising childcare costs.

- Enhanced Quality Standards: States are expected to implement stricter quality requirements for childcare providers receiving CCDF subsidies, focusing on staff training, health and safety, and developmentally appropriate practices.

- Broader Eligibility Criteria: Some states may expand income eligibility thresholds to include more working families who struggle with childcare expenses but previously earned too much to qualify.

These federal directives set the stage for how states will structure their own programs, making it essential for parents to monitor both national policy shifts and local adaptations. The financial impact of CCDF on families can be substantial, often covering a significant portion of childcare costs.

Navigating State-Specific Childcare Assistance Programs

Beyond federal grants, each state operates its own unique set of childcare assistance programs, often supplementing CCDF funds with state-appropriated dollars. These programs vary widely in terms of eligibility, benefit levels, and application procedures, reflecting diverse local needs and legislative priorities. Families must delve into their specific state’s offerings to maximize their potential for support.

States like California, New York, and Massachusetts have historically invested heavily in childcare subsidies, often through initiatives that go beyond federal minimums. Conversely, states with tighter budgets may offer more targeted programs or have longer waiting lists. Knowing your state’s approach is a critical step in childcare grants 2025 planning.

Examples of State Program Variations

- Sliding Scale Fees: Many states utilize a sliding scale for co-payments, where families pay a percentage of the childcare cost based on their income, making care more affordable.

- Pre-Kindergarten Programs: Several states offer universal or targeted pre-kindergarten programs, providing free or low-cost early education for 3- and 4-year-olds, thereby reducing the need for traditional childcare.

- Employer-Sponsored Initiatives: Some states incentivize employers to offer childcare benefits, which can indirectly support families through tax credits or direct subsidies to providers.

Staying informed about your state’s particular programs, including any changes announced for 2025, is key. State child care resource and referral agencies (CCR&Rs) are invaluable resources for detailed local information and application assistance.

Eligibility Requirements: Who Qualifies for Childcare Grants in 2025?

Eligibility for childcare grants 2025, whether federal or state-funded, typically hinges on several key factors. These commonly include household income, family size, the child’s age, and the parents’ work or education status. While the specifics can vary, a general understanding of these criteria is essential for families considering application.

Income thresholds are usually set as a percentage of the State Median Income (SMI) or the Federal Poverty Level (FPL). For instance, many programs target families earning up to 85% of the SMI. Additionally, parents often need to be working, attending school, or participating in job training programs to qualify, demonstrating a need for childcare due to these activities.

Children typically need to be under the age of 13, or up to 19 if they have special needs and require childcare due to a physical or mental incapacity. Some programs may also consider specific vulnerabilities, such as children experiencing homelessness or those in protective services, allowing for broader access to support.

Common Eligibility Criteria

- Income Limits: Household income must fall below a certain percentage of the state median income or federal poverty line.

- Work/Activity Requirements: Parents or guardians must typically be employed, seeking employment, or enrolled in an educational or training program.

- Child’s Age: Generally, children must be under 13 years old, with exceptions for children with disabilities up to age 19.

- Residency: Families must reside in the state or local jurisdiction where they are applying for assistance.

It is crucial for families to gather all necessary documentation, including proof of income, residency, and work/school status, before initiating the application process to avoid delays. Eligibility criteria are subject to change, so consulting official state websites is always recommended.

The Application Process: A Step-by-Step Guide for 2025

Applying for childcare grants 2025 can seem daunting, but breaking it down into manageable steps can simplify the process significantly. While procedures vary by state and program, a general roadmap can help families prepare and navigate the necessary paperwork and deadlines. Timely and accurate submission is key to securing funding.

Most states utilize a centralized application portal or a designated agency, often the Department of Social Services or a similar entity. The initial step usually involves completing a pre-screening questionnaire to determine preliminary eligibility, followed by a more detailed application that requires extensive documentation. Families should anticipate providing financial records, birth certificates, and proof of address.

Keeping copies of all submitted documents and correspondence is a best practice. Follow-up is also important, as processing times can vary. Some programs operate on a first-come, first-served basis, while others may have specific enrollment periods or waiting lists.

Essential Steps in the Application Process

The first step is identifying eligible programs. This involves researching both federal and state-specific options that align with your family’s needs and income level. Many states have online tools or local agencies that can help match families with suitable programs.

Next, gather all required documents. This typically includes recent pay stubs, tax returns, proof of residence, birth certificates for all children, and documentation of work or school enrollment. Having these prepared in advance will significantly speed up the application. Completing the application form accurately and thoroughly is critical; any omissions or errors can lead to delays or rejection. Many applications are now available online, offering a more convenient submission method.

Finally, submit your application and follow up. After submission, regularly check the status of your application. Be prepared to provide additional information if requested. Some programs may require an interview or a home visit as part of their verification process.

Maximizing Financial Impact: Insider Knowledge for Families

Beyond simply applying, families can employ strategies to maximize the financial impact of childcare grants 2025. Insider knowledge often involves understanding program intricacies, leveraging multiple resources, and proactively managing your financial situation in relation to eligibility criteria. This proactive approach can lead to greater savings and more stable childcare arrangements.

One key strategy is to explore stacking benefits. While some programs have restrictions on receiving multiple forms of assistance simultaneously, others can be combined. For example, a family might receive a state childcare subsidy while also benefiting from a federal tax credit for dependent care expenses. Understanding these potential overlaps can yield significant financial relief.

Another crucial tip is to maintain open communication with your chosen childcare provider. Many providers are knowledgeable about the various assistance programs and can offer guidance or help with the application process, particularly regarding provider-specific documentation. They often have experience working with subsidized families and can be a valuable resource.

Tips for Optimizing Your Childcare Grant Benefits

- Understand Co-payment Structures: Familiarize yourself with how your co-payment is calculated and if there are options for reducing it, such as through increased work hours or participation in specific programs.

- Seek Out Quality Providers: While grants help with cost, prioritize providers who meet high-quality standards, as this directly impacts your child’s development and your peace of mind.

- Monitor Program Changes: Government programs are subject to change. Regularly check official websites and local news for updates to eligibility, funding, or application deadlines to ensure continuous support.

- Consider Tax Credits: Alongside grants, explore federal and state tax credits for childcare expenses, which can provide additional financial relief at tax time.

Proactive engagement with these programs, coupled with careful financial planning, empowers families to make the most of available resources and secure stable, affordable childcare.

Challenges and Outlook for Childcare Grants in 2025

While the outlook for childcare grants 2025 offers significant opportunities for families, several challenges persist that could impact the availability and effectiveness of these programs. These include ongoing funding debates, workforce shortages in the childcare sector, and the ever-present demand that often outstrips supply.

Congressional appropriations for federal programs like CCDF are subject to political negotiations, which can create uncertainty around future funding levels. States, too, face budget constraints that might limit their ability to expand or even maintain current levels of childcare assistance. These financial realities underscore the need for continued advocacy from families and childcare providers.

Furthermore, the childcare industry continues to grapple with a severe workforce shortage, contributing to rising costs and limited availability of slots. Even with financial assistance, finding a high-quality, affordable childcare provider can be a significant hurdle for many families. Policy discussions in 2025 are expected to address these systemic issues more directly.

Anticipated Challenges and Future Considerations

One significant challenge is the sustainability of funding. While temporary pandemic-era relief boosted childcare funding, maintaining those levels requires sustained political will and economic stability. Advocacy groups are pushing for permanent, robust funding streams to stabilize the sector.

Another hurdle is the administrative burden on both families and providers. Simplifying application processes and reducing paperwork can improve access and retention in programs. Technological solutions are being explored to streamline these administrative tasks.

Lastly, the quality versus affordability dilemma remains. As programs push for higher quality standards, the cost of providing care can increase, potentially making it harder for providers to accept subsidized rates without additional support. Balancing these factors is crucial for the long-term success of childcare grant initiatives.

Key Aspect |

Brief Description > |

|---|---|

Federal CCDF |

Primary federal funding for states to assist low-income families with childcare costs. |

State Programs |

Vary by state, supplementing federal aid with unique eligibility and benefit structures. |

Eligibility |

Based on income, family size, child’s age, and parents’ work/school status. |

Financial Impact |

Significant cost reduction, potentially allowing for higher quality care and family financial stability. |

Frequently Asked Questions About Childcare Grants in 2025

The main source is the federal Child Care and Development Fund (CCDF), which allocates money to states. Additionally, most states have their own independently funded programs that complement or expand upon federal assistance, often with specific local criteria.

Eligibility typically depends on your household income relative to state median income, family size, the age of your children, and whether parents are working, in school, or actively seeking employment. Check your state’s Department of Social Services website for specific 2025 guidelines.

▼

Commonly required documents include proof of income (pay stubs, tax returns), proof of residency, birth certificates for children, and documentation of work or school enrollment. Having these ready can significantly expedite the application process.

Generally, grants can be used for licensed childcare centers, family childcare homes, and some informal care arrangements, provided the provider meets state-specific health, safety, and quality standards. Always confirm with your state’s program administrator or chosen provider.

Yes, many families can also claim federal tax credits, such as the Child and Dependent Care Credit, and potentially state-specific tax credits, which can further reduce childcare costs. Consult a tax professional for personalized advice on combining benefits.

What This Means for Families

The landscape of childcare grants 2025 presents a vital opportunity for families to secure essential financial support for their children’s care. Understanding the distinct roles of federal and state programs, staying updated on eligibility changes, and navigating the application process effectively are critical steps. As the year progresses, families should remain vigilant about policy updates and leverage available resources to ensure their children receive quality care while managing household finances. Proactive engagement will be key to unlocking these critical benefits.