FAFSA 2025-2026 Updates: Maximize College Financial Aid

The 2025-2026 FAFSA updates introduce significant changes impacting financial aid eligibility and application processes. This guide offers practical solutions to help families maximize college funding opportunities amid these recent developments.

Understanding the FAFSA Updates for 2025-2026: A Step-by-Step Guide to Maximizing College Financial Aid (RECENT UPDATES, PRACTICAL SOLUTIONS) is shaping today’s agenda with new details emerging from the Department of Education. These crucial changes will directly impact how millions of students access federal financial aid, making it imperative for families to grasp the revised processes and leverage new opportunities. Our report clarifies what has changed, why it matters, and what proactive steps families must take now to secure essential college funding.

Decoding the FAFSA Simplification Act and Its Impact

The FAFSA Simplification Act, enacted by Congress, aims to streamline the federal student aid application process and expand eligibility for federal student aid. For the 2025-2026 award year, these changes will fully take effect, bringing both relief and new complexities for applicants. Understanding the core tenets of this act is the first step toward navigating the updated landscape effectively.

Previously, the FAFSA form was notoriously long and complex, often deterring eligible students from applying. The simplification efforts seek to reduce the number of questions, integrate data directly from the IRS, and clarify eligibility criteria. However, initial rollout challenges for the 2024-2025 cycle have highlighted the importance of being prepared for potential glitches and understanding the revised terminology.

Key Legislative Changes and Their Implications

The act introduces several pivotal changes that will redefine how financial need is calculated and how aid is distributed. These include a new methodology for determining aid eligibility and shifts in how family income and assets are assessed. Families need to be aware of these fundamental alterations to accurately project their aid eligibility.

- Student Aid Index (SAI) Replaces EFC: The Expected Family Contribution (EFC) is now replaced by the Student Aid Index (SAI). This new metric is designed to be a more accurate assessment of a student’s financial need and can be as low as -$1, indicating maximum need.

- Expanded Pell Grant Eligibility: The new FAFSA significantly expands Pell Grant eligibility to more students, linking it to the federal poverty level and family size. This means more low-income students will qualify for the maximum Pell Grant award.

- Fewer Questions, Direct Data Exchange: The number of questions on the FAFSA form has been substantially reduced. Crucially, the form now directly imports tax data from the IRS via a mandatory data exchange, minimizing manual entry errors and simplifying the process for most applicants.

- Separate Application for Parents in Divorced Households: For divorced or separated parents, the parent who provides the most financial support to the student will now be required to complete the FAFSA, regardless of which parent the student lives with. This is a significant change from the previous rule which focused on the custodial parent.

These legislative changes are not merely procedural; they represent a fundamental shift in the philosophy of federal financial aid. The goal is to make higher education more accessible and affordable, particularly for underserved populations. Families should examine how these specific changes apply to their unique financial circumstances to anticipate potential aid outcomes.

Navigating the New FAFSA Form: What’s Different?

The updated FAFSA form for 2025-2026 is designed to be more user-friendly, but its new structure and terminology require careful attention. Families must familiarize themselves with the revised sections and understand how their financial information will now be processed. The changes are not just cosmetic; they impact the very calculation of your student aid eligibility.

One of the most significant changes is the mandatory direct data exchange with the IRS. While this aims to simplify the process and reduce errors, it also means applicants must consent to this data retrieval. Without consent, the student will not be eligible for federal student aid. This consent requirement is a critical step that families cannot overlook.

Key Changes in the Application Process

The application experience itself has undergone a transformation. The FAFSA is now primarily online, with an emphasis on digital submission. While a paper form will still be available for those without internet access, the digital platform is the preferred and most efficient method. Understanding the digital interface and its requirements is key.

- Mandatory IRS Direct Data Exchange: All contributors (student, parent(s), spouse) must provide consent for the IRS to share their tax information directly with the Department of Education. This is non-negotiable for federal aid eligibility.

- Contributor Role Defined: Anyone required to provide information on the FAFSA (parents, stepparents, student’s spouse) is now termed a ‘contributor’. Each contributor will receive an email to access and complete their specific section of the FAFSA.

- Streamlined Dependency Status Questions: The questions determining a student’s dependency status have been simplified, aiming to make it easier for students to understand if they are considered dependent or independent for financial aid purposes.

- Removal of Number in College Question: The previous FAFSA included a question about the number of family members attending college. This question has been removed, which may impact aid calculations for families with multiple children in higher education.

These procedural adjustments, especially the mandatory IRS data exchange and the new contributor model, necessitate a coordinated effort from all parties involved. Proactive communication and understanding of each contributor’s role will be essential for a smooth application process.

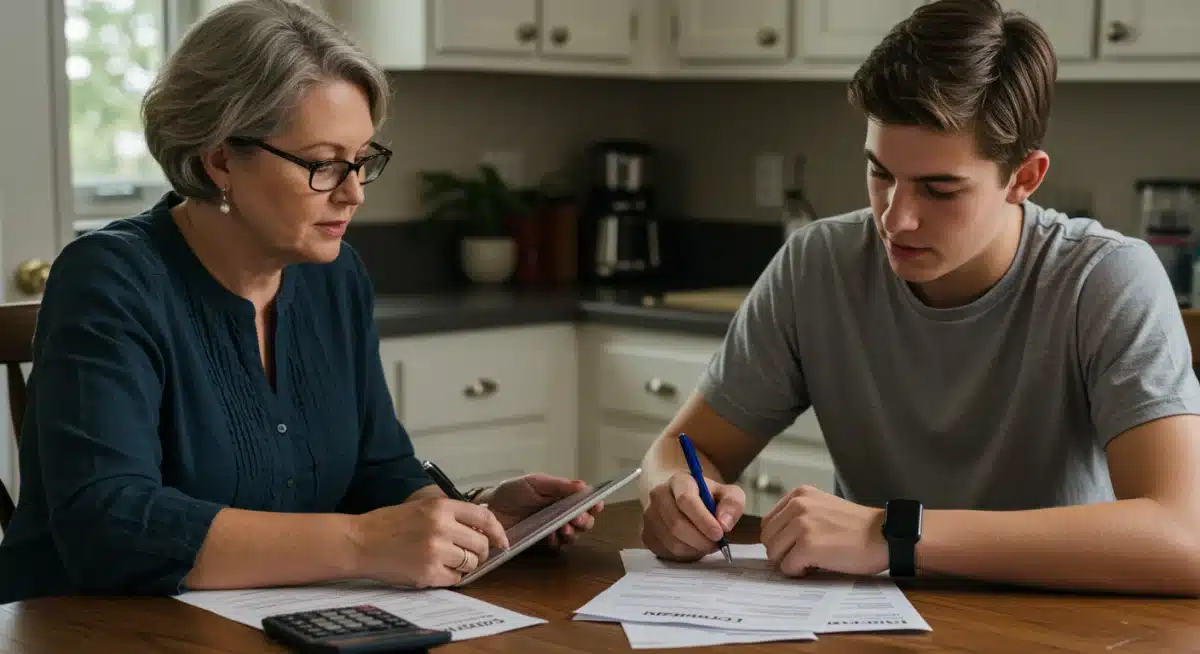

Maximizing Aid: Strategic Planning for Families

With the 2025-2026 FAFSA updates, strategic planning becomes even more critical for families aiming to maximize their college financial aid. The shift from EFC to SAI, coupled with changes in asset assessment, means that previous strategies might need to be re-evaluated. Families need to consider how their income and assets are reported and adjust where possible to present the most favorable financial picture.

One common misconception is that only low-income families qualify for aid. While Pell Grants are primarily for low-income students, other federal aid, including federal student loans and some scholarships, are available regardless of income. Therefore, every family should complete the FAFSA, as it is the gateway to all federal and most state and institutional aid.

Practical Solutions and Best Practices

To optimize your aid eligibility, consider these actionable steps and best practices. These strategies focus on presenting your finances accurately and strategically, within the confines of the new FAFSA regulations. Remember, timing and accuracy are paramount.

- Gather Documents Early: Collect all necessary tax documents (W-2s, tax returns, etc.) well in advance. For the 2025-2026 FAFSA, you will need 2023 tax information. Having these ready will expedite the IRS data retrieval process.

- Understand Asset Reporting: Certain assets, like retirement accounts (401k, IRA) and the value of your primary residence, are not counted in the SAI calculation. However, non-retirement investment accounts and college savings plans (529 plans) owned by the parent are. Strategically consider how assets are held.

- Create an FSA ID for All Contributors: Every contributor (student, parent(s), spouse) must have a verified FSA ID to access and sign the FAFSA. This ID serves as a legal signature and is crucial for the mandatory IRS data exchange.

- Apply as Soon as Possible: While the FAFSA has no hard deadline for federal aid, many states and colleges have their own deadlines and award aid on a first-come, first-served basis. Submitting early increases your chances of receiving maximum available aid.

Adopting these practices can significantly improve your chances of securing more financial aid. It’s about being prepared, understanding the rules, and acting promptly within the new framework established by the FAFSA Simplification Act.

Common Pitfalls to Avoid in the New FAFSA Process

Despite efforts to simplify the FAFSA, new complexities can arise, leading to common pitfalls that might delay your application or reduce your aid eligibility. Being aware of these potential issues and knowing how to circumvent them is crucial for a smooth and successful application. Even seemingly minor errors can have significant consequences.

One frequently encountered problem is incorrect or incomplete information. While the IRS data exchange reduces some manual entry, applicants are still responsible for ensuring all other information is accurate. Double-checking every detail before submission can save considerable time and stress later on. Furthermore, families often underestimate the time required for the entire process, leading to last-minute rushes.

Troubleshooting and Avoiding Delays

To ensure a seamless FAFSA application, focus on preventative measures and be prepared to troubleshoot common issues. Proactive engagement with the process can help avoid many of the delays and frustrations experienced by others.

- FSA ID Issues: Ensure all contributors create and verify their FSA IDs well in advance. Delays in verification (which can take up to three days) can hold up the entire application. Without a verified FSA ID, you cannot complete the mandatory IRS data exchange.

- Consent for IRS Data Exchange: The most critical step is providing consent for the IRS data exchange. Failure to do so by any contributor will result in the student being ineligible for federal student aid, even if they manually enter tax information.

- Understanding Contributor Roles: Clearly identify who is a ‘contributor’ in your family’s situation. Incorrectly identifying contributors or failing to have all required contributors complete their section will lead to an incomplete FAFSA.

- Missed Deadlines: Keep track of federal, state, and institutional FAFSA deadlines. Deadlines vary significantly, and missing one could mean missing out on certain types of aid. Create a calendar and set reminders.

By taking these precautions, families can significantly reduce the likelihood of encountering common problems. A meticulous approach to each step of the new FAFSA process will ultimately pay off in a more efficient application and potentially greater financial aid.

Beyond FAFSA: Exploring Other Financial Aid Avenues

While the FAFSA is the cornerstone of federal financial aid, it is by no means the only source of college funding. Families should broaden their search to include state aid programs, institutional scholarships, and private scholarships. A comprehensive financial aid strategy involves exploring all available avenues to minimize out-of-pocket college costs.

Many students make the mistake of relying solely on federal aid, unaware of the vast array of other opportunities. Colleges themselves often have significant endowments dedicated to student support, and numerous private organizations offer scholarships based on merit, need, background, or specific talents. These additional sources can bridge the gap between federal aid and the total cost of attendance.

Diversifying Your Financial Aid Search

To truly maximize college financial aid, a diversified approach is essential. Don’t put all your eggs in the federal aid basket. Consider these additional resources to build a robust financial aid package.

- State Grant and Scholarship Programs: Many states offer their own grant and scholarship programs, often with specific residency and academic requirements. Check your state’s higher education agency website for details and deadlines.

- Institutional Aid: Colleges and universities often have their own scholarship and grant programs, sometimes based on academic achievement, specific talents (athletics, arts), or demonstrated need. Always inquire directly with the financial aid office of each prospective school.

- Private Scholarships: Numerous foundations, corporations, and community organizations offer private scholarships. Websites like Fastweb, Scholarship.com, and the College Board’s Scholarship Search are excellent resources for finding these opportunities.

- Employer Tuition Benefits: Some employers offer tuition reimbursement or scholarship programs for employees or their dependents. Inquire with your or your parent’s HR department about potential benefits.

By actively pursuing these diverse financial aid avenues in conjunction with a meticulously completed FAFSA, families can significantly reduce the financial burden of higher education. This multi-pronged approach ensures that no potential source of funding is overlooked.

Future Outlook: What to Expect Post-FAFSA Submission

Once the 2025-2026 FAFSA is submitted, the process doesn’t end. Families should understand the subsequent steps, including receiving aid offers, understanding their Student Aid Index (SAI), and the timeline for receiving funds. Post-submission vigilance is just as important as the application itself to ensure a successful financial aid outcome.

The Department of Education will process the FAFSA and send the student a FAFSA Submission Summary, which replaces the Student Aid Report (SAR). This summary will detail the student’s SAI and other important information. It’s crucial to review this document carefully for any errors, as corrections might still be possible.

Understanding Your Aid Offer and Next Steps

After your FAFSA is processed and sent to the colleges you listed, each institution will begin to assemble a financial aid offer. These offers can vary widely from school to school and are influenced by the institution’s resources and your demonstrated need. Understanding how to interpret these offers is key to making informed decisions.

- Review FAFSA Submission Summary: This document will be sent to the student after the FAFSA is processed. It contains your SAI and confirms the data submitted. Review it for accuracy and make any necessary corrections promptly.

- Compare Financial Aid Offers: Each college you applied to will send you a financial aid offer. Compare these offers carefully, paying attention to the mix of grants, scholarships, work-study, and loans. Understand the net price (cost of attendance minus grants and scholarships).

- Understand Loan Terms: If you accept federal student loans, ensure you understand the interest rates, repayment terms, and your responsibilities. Federal loans generally offer more protections and benefits than private loans.

- Appeal if Necessary: If your family’s financial situation has changed significantly since the tax year used on the FAFSA, or if you believe there are special circumstances not captured by the form, you can appeal your financial aid offer to the college’s financial aid office.

The period post-submission is a critical phase for evaluating options and making informed decisions about college financing. By carefully reviewing all documents and understanding the terms of any aid offered, families can confidently move forward with their higher education plans.

| Key FAFSA Update | Brief Description |

|---|---|

| SAI Replaces EFC | Student Aid Index (SAI) is the new measure of financial need, potentially as low as -$1. |

| Mandatory IRS Data Exchange | Consent for IRS tax data sharing is required for all contributors for federal aid eligibility. |

| Expanded Pell Grants | Eligibility for Pell Grants is broadened, linking to federal poverty levels and family size. |

| New Contributor Model | Anyone providing data on FAFSA is a ‘contributor,’ each needing an FSA ID and consent. |

Frequently Asked Questions About FAFSA Updates

▼

The most significant change is the replacement of the Expected Family

Contribution (EFC) with the Student Aid Index (SAI). This new formula

aims for a more accurate assessment of a student’s financial need,

potentially leading to increased aid for many families.

▼

Yes, absolutely. The FAFSA is the gateway to all federal student aid,

including federal student loans, which are available regardless of

income. Many state and institutional aid programs also require a

completed FAFSA, so it’s always worth applying.

▼

The mandatory IRS direct data exchange allows the FAFSA to pull tax

information directly from the IRS. It’s crucial because all contributors

must consent to it; without consent, students will not be eligible for

federal financial aid.

▼

The removal of this question means that having multiple children in

college will no longer automatically divide the SAI. This change may

result in a higher SAI for families with multiple college students,

potentially impacting their aid eligibility.

▼

If your financial situation has significantly changed (e.g., job loss,

medical expenses), contact the financial aid office of the colleges you

are applying to. They have a process for professional judgment to adjust

your aid based on special circumstances.

Next Steps for Families

The 2025-2026 FAFSA updates represent a significant evolution in college financial aid, presenting both challenges and opportunities. Families must remain informed, proactive, and meticulous throughout the application and post-submission phases. As details continue to emerge and colleges adapt their processes, ongoing engagement with financial aid resources and timely action will be paramount to securing the best possible outcomes for students pursuing higher education.